Building Permanent Support for Our Community

MCF is dedicated to creating a permanent endowment for the community. This model of investing ensures that we are creating an enduring source of support for the organizations in our community, long into the future.

To help ensure both maximum charitable impact and fund longevity, we take managing the investment of the assets entrusted to us seriously. MCF’s investment policy is guided by our knowledgeable and experienced investment committee which consists of knowledgeable volunteers and board members. The committee works closely with Commonfund/OCIO, the only nonprofit investment management firm in the country, which serves as MCF’s outsourced chief investment officer.

Offering Fundholders Investment Options

MCF offers fundholders a choice of investment portfolios so they can align their fund investments with their values. All contributions and gifts to MCF are consolidated into either our Diversified Portfolio or our Environmental, Social and Governance Portfolio and managed collectively under the oversight of the investment committee and Commonfund/OCIO.

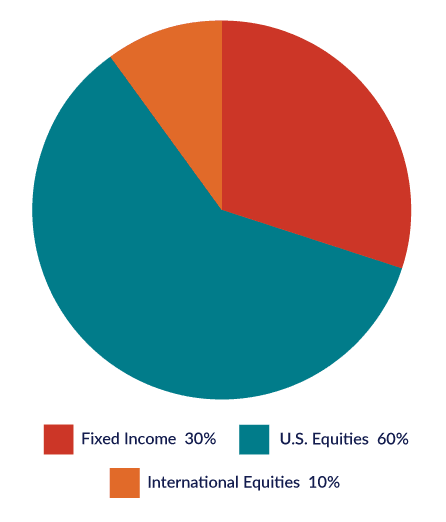

Diversified Portfolio

Commonfund’s OCIO division has more than $17 billion assets under management for endowments and foundations. The Diversified Portfolio is invested with a perpetual time horizon and managed to provide long-term growth and stability. The Diversified Portfolio’s strategic asset allocation is:

ESG Portfolio

Managed by Boston Trust Walden, which has been a leader in ESG investing since 1974 and has more than $16.5 billion assets under management, the portfolio uses a shareholder activism strategy in addition to screening to achieve its ESG goals. The ESG Portfolio’s strategic asset allocation is:

Strategic Asset Allocation

Strategic Asset Allocation

2024 Financial Highlights

MCF continued to grow in 2024, welcoming new fundholders and increasing the gifts distributed to the community.

$460 Million

Consolidated assets

$41 Million

New gifts received

$22 Million

Distributed to the community

Investment and Endowment Overview Statements

-

MCF Investment Overview as of 12/31/2025

-

Commonfund Endowment Overview as of 12/31/2025

Financial Documents

MCF Investment Committee

- Gary Mecklenburg, Chair – retired, Northwestern Memorial HealthCare

- Anne Lucke, Ex-Officio

- Anna Burish – UBS Financial Services, Inc.

- Chuck Carpenter – retired, State of Wisconsin Investment Board

- Beth Holzberger – State of Wisconsin Investment Board

- Ron Mensink – retired, State of Wisconsin Investment Board\

- Tom Olson – retired, University of Wisconsin Foundation

- Sebastien Plante – UW-Madison School of Business

- Blaine Renfert – General Counsel with Sub-Zero Group, Inc.

- David Stark – Stark Company Realtors